Business Segments

OVERVIEW OF THE PROCESS

Greenfield will utilize its Gulf grain export market position to integrate into more upstream activities. By owning the pinch point in the grain supply chain, Greenfield can look to further integrate up the grain supply chain through building relationships with farmers and supply marketers and owning inland assets on major waterways to internally supply the export elevator with grain. Owning the export elevator and inland grain elevators will allow Greenfield to find arbitrage trading opportunities as it will utilize its vertical integration to take advantage of higher priced markets.

Export Grain Elevator

Greenfield is building the first new grain export elevator constructed in Louisiana since 1979, a $400 million project.

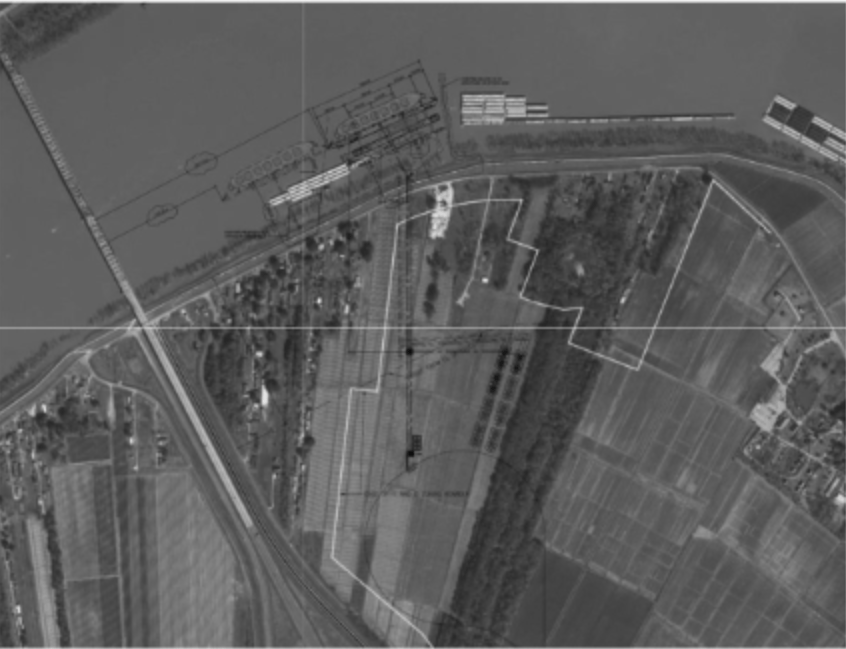

Located in St. John the Baptist Parish, Louisiana on the Lower Mississippi River (LMR), Greenfield has secured a 1,300-plus acre parcel of land with 3,400 feet of river front and deep-water access. The new grain export elevator will operate in concert with the inland assets.

The elevator has an annual capacity of 11 million tons with an upside of 22 million tons. This equates to 400 million bushels annually.

Louisiana, especially the Port of South Louisiana, where Greenfield is located , is the largest export market for US grain with ~45% of all American grain exports passing through it.

The export elevator, which requires the greatest capital ($46mm) of any of Greenfield's business segments, is the linchpin in Greenfield executing its business plan because of its scale, position in the market, and open supply. The export elevator will receive bushels, predominately via barge, and load those bushels onto oceangoing vessels.